Child Tax Credit Expansion in 2021

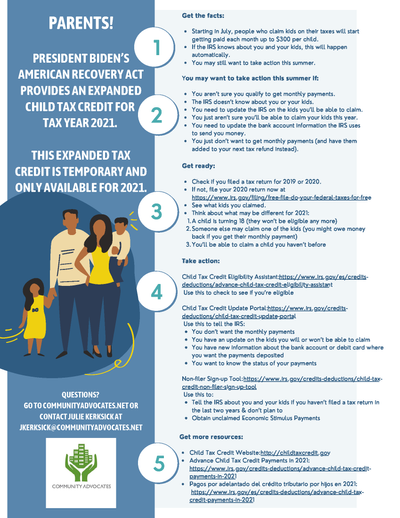

President Biden’s American Recovery Act provides an expanded Child Tax Credit for tax year 2021. More families are eligible for this tax credit, and the amount available to parents has increased. This expanded tax credit is temporary and only available for 2021.

The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and most families will automatically receive monthly payments without having to take any action.

- Starting in July, people who claim kids on their taxes will start getting paid each month up to $300 per child

- If the IRS knows about you and your kids, this will happen automatically

- You may still want to take action this summer to make sure you receive this tax credit

Who Is Eligible?

Parents of children through age 17 who claim their kids on their taxes and live in the U.S. for at least half of 2021 will receive the full tax credit if they are:

- Married and file a joint return or are a qualifying widow/widower with incomes up to $150,000

- A head of household with an income up to $112,500

- Single filers or married persons filing separate returns with an income up to $75,000

Tax filers who don’t have earned income in 2021 or who don’t owe any taxes are eligible. Taxpayers with higher incomes may receive a reduced amount of the Child Tax Credit.

Children must have a Social Security Number (SSN) to be eligible for this benefit. Parents must have an SSN or an Individual Taxpayer Identification Number (ITIN).

You can check your eligibility at the Advance Child Tax Credit Eligibility Assistant. Click here to learn more.

Mixed Immigration Status Families

Parents of children ages 17 and younger with Social Security Numbers valid for US employment can receive the expanded Child Tax Credit as long as they have an ITIN. DACA recipients are eligible for the tax credit if the children have a valid Social Security Number. If you receive the Child Tax Credit, it does not affect your immigration status or ability to become a citizen, and it does not affect your ability to get a green card. For more details, go to the Center for Law and Social Policy’s website in English or en Español.

How Much is the Expanded Child Tax Credit?

The maximum credit available to eligible parents will receive:

- $3,600 per qualifying child under the age of 6 at the end of 2021

- $3,000 per qualifying child between the ages of 6 and 17 at the end of 2021

Will the Child Tax Credit Affect Other Government Benefits?

No. Receiving Child Tax Credit payments is not considered income for any family. Therefore, it will not change the amount you receive in other federal benefits. These federal benefits include unemployment insurance, Medicaid, SNAP, SSI, SSDI, TANF, WIC, Section 8, or Public Housing.

How It Works

On July 15, 2021, the IRS will begin paying out a portion of the Child Tax Credit in monthly payments to eligible parents. Starting in July 2021 through December 2021, eligible families will begin to receive:

- Monthly payments of $300 maximum for each child under 6

- Monthly payments of $250 maximum for each child 6 to 17 years old

After December 15, 2021, the balance of the Child Tax Credit that hasn’t been paid out will be available when parents file their 2021 taxes.

Please note: Be alert for scams. The BBB expects impostor scams to pop up with con artists pretending to help you get your payment earlier, get more money or commit identity theft. The IRS will not call, text, DM, or email you. If someone contacts you about your Child Tax Credit payment, do not give out any personal information, like Social Security numbers, bank account information, or credit/debit card numbers. If you believe you have been contacted by someone trying to scam you, you can report it to the BBB at www.bbb.org/wisconsin, (414) 847-6000 or 1-800-273-1002.

What You Need to Do

If you filed taxes in 2020, you will receive a letter from the IRS about your Child Tax Credit. You do not need to do anything to claim this credit. The payments will be sent to your bank account or the street address listed on your tax documents.

If your information has not changed since you filed, you do not need to do anything.

However, you may want to take action this summer if:

- You aren’t sure you qualify to get monthly payments.

- The IRS doesn’t know about you or your kids.

- You need to update the IRS on the kids you’ll be able to claim.

- You just aren’t sure you’ll be able to claim your kids this year.

- You just don’t want to get monthly payments (and have them added to your next tax refund instead).

Here’s what you need to do to take action:

- Check if you filed a tax return for 2019 or 2020. If not, file your 2020 return now. Check out this website to learn how to file your taxes for free.

- See what kids you claimed.

- Think about what may be different for 2021:

- A child is turning 18 (they won’t be eligible any more)

- Someone else may claim one of the kids (you might owe money back if you get their monthly payment)

- You’ll be able to claim a child you haven’t before

Resources

Questions about accessing the Child Tax Credit for 2021? Contact Julie Kerksick, Senior Policy Advocate, at jkerksick@communityadvocates.net.

-

This page covers the basic facets of the temporary Child Tax Credit expansion, Frequently Asked Questions, and links to data.

-

El Crédito Tributario por Hijos del Plan de Rescate Económico proporciona el Crédito Tributario por Hijos más grande de la historia y un alivio histórico para la mayoría de las familias trabajadoras.

-

An easy-to-understand guide to the changes in the Child Tax Credit for 2021.

-

Use the assistant to check if you might be eligible for advance payments of the Child Tax Credit.

-

Nuts and bolts information about the expanded child tax credit and taxes.

-

Los cambios importantes que se han efectuado al crédito tributario por hijos ayudarán a muchas familias a obtener pagos adelantados de este crédito comenzando este verano.

-

If you didn’t make enough to be required to file taxes in 2020 or 2019, you can still get benefits. Please note that this site is not mobile-friendly and only works on laptop and desktop computers. Users will need an email address. Learn more at this link.

-

Los cambios importantes que se han efectuado al crédito tributario por hijos ayudarán a muchas familias a obtener pagos adelantados del crédito tributario por hijos comenzando en verano de 2021.

-

Use this tool to: view your eligibility, view your advance payments, and unenroll from getting advance payments.

-

Learn about eligibility, impact on taxes, and more on the IRS's FAQ page.

-

Obtenga más información sobre los pagos por adelantado del crédito fiscal por hijos y el crédito fiscal por hijos de 2021.

-

A quick guide on how you can be ready to receive advance Child Tax Credit payments in 2021.

-

These short, easy-to-understand videos explain how you can claim the expanded Child Tax Credit and how it will impact you.