Community Advocates and the Milwaukee Property Tax Appeals Project address critical needs in Milwaukee by focusing on preventing property tax foreclosures and confronting disparities in property tax assessments.

In 2022 and 2023, the City filed over 330 foreclosure actions in court, putting hundreds of families who owe nothing on their mortgages at risk of losing their homes, often because they cannot pay their property taxes.

What the Milwaukee Property Tax Appeals Project Does

The Milwaukee Property Tax Appeals Project addresses a critical unmet need by providing comprehensive foreclosure prevention and property tax assessment appeal services, previously unavailable through any local nonprofit.

Here’s what we do:

- Deliver legal and financial assistance to at-risk homeowners, helping them delay or avoid foreclosure.

- Reduce at-risk homeowners’ tax burden through assessment appeals.

- Connect homeowners with essential support services, including utility and home repair assistance, to improve affordability and ensure housing stability.

- Empower residents through advocacy, actively involving them in campaigns to reform tax policies that disproportionately impact marginalized communities.

Current Programs: On hold temporarily.

2025 Property Tax Foreclosure Prevention: We have temporarily paused accepting new applications.

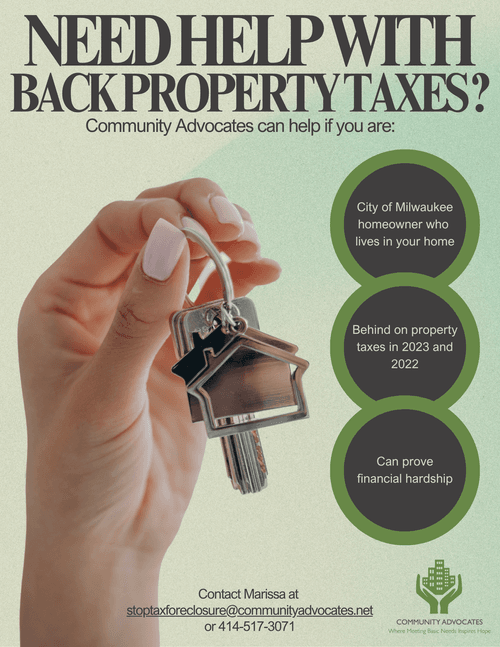

If you received a tax foreclosure notice from the City of Milwaukee, you are at risk of losing your home. However, if you own and live in your home and can prove financial hardship, Community Advocates' Property Tax Foreclosure Prevention program may be able to help you access free funding and other services to help prevent tax foreclosure and keep you in your home. If you are interested in setting up an appointment with us, please use this link: https://calendly.com/stopforeclosuremke/30min.

About the Milwaukee Property Tax Appeals Project

Partnering with the University of Wisconsin Law School, the project has offered pro bono legal services for homeowners facing tax foreclosure. Under supervision, law students filed legal requests to delay tax foreclosures while our project advocate connected homeowners with supportive services such as financial assistance with late property taxes, utility assistance, and home repair grants and loans to increase homeownership affordability and stability . This partnership provides essential legal support, expanding the project’s capacity to address clients’ immediate needs while advocating for long-term change.

A second focus of the project is to reduce tax burdens on low-income, lower-value homeowners by providing assessment appeal services modeled after Detroit’s Property Tax Appeals Project. This initiative helps homeowners of lower-value properties secure fairer tax assessments, reducing tax foreclosure risks.

To drive broader policy change, the project collaborates with the Coalition for Property Tax Justice, encouraging homeowners to join campaigns for equitable tax policies. Engaging those affected fosters a community-led approach to systemic reform, empowering residents to advocate for fairer property taxation.

Please note that our programs are temporarily on hold and we are not accepting new applications at this time. To get in touch with the Milwaukee Property Tax Appeals Project, contact Marissa Boston at mboston@communityadvocates.net.